The smell of new notebooks, the excitement of fresh uniforms, the hopeful buzz of a new school year—it’s supposed to be a joyful ritual. But for many parents, back-to-school season now comes with something else: dread. Not because they don’t want the best for their kids, but because affording it feels increasingly out of reach.

From tech requirements to social expectations, the cost of sending a child to school has ballooned into a financial minefield. And for families already stretched thin, it’s not just inconvenient—it’s destabilizing.

When “School Supplies” Start Looking Like Luxury Goods

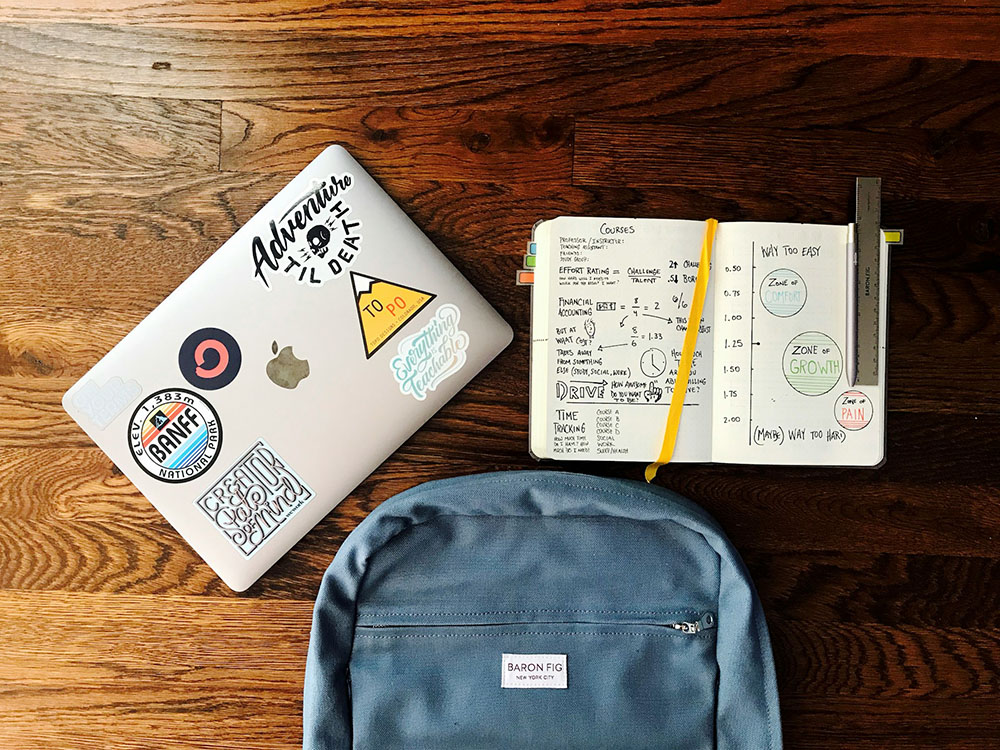

Forget the days when a backpack, pencils, and a few notebooks did the job. Today’s classroom demands have escalated:

- Tech essentials: Laptops, tablets, graphing calculators, and subscriptions to learning platforms are now standard. Some schools even require specific brands or models—costing families $500 or more per child.

- Uniforms and dress codes: Especially in private or charter schools, uniforms aren’t just mandatory—they’re expensive, often with limited resale or reuse options.

- Inflated basics: Thanks to global supply chain issues, even simple items like glue sticks and lunch boxes have seen price hikes.

And that’s before you factor in transportation, lunch programs, field trip fees, and “voluntary” school donations that don’t feel so voluntary.

The Pressure to Perform—Even at the School Gate

It’s not just the receipts piling up—it’s the expectations. Social media has turned back-to-school into a performance art:

- Instagram-worthy moments: Perfectly styled outfits, themed lunch boxes, and elaborate “first day” photo shoots set unrealistic standards.

- Guilt-driven spending: Parents feel the need to keep up—not just with classmates, but with curated online personas.

- Peer pressure trickle-down: Kids notice who has the latest gear. And when they feel left out, parents feel responsible.

The result? Families spending beyond their means—not out of vanity, but out of love, fear, and a desire to protect their children from exclusion.

Debt in Disguise: The Rise of “Buy Now, Regret Later”

To bridge the gap, many parents turn to credit cards or installment services like “Buy Now, Pay Later.” These tools offer temporary relief—but often at a steep long-term cost.

- Credit card creep: A few swipes in August can turn into lingering debt by December, especially with high interest rates.

- BNPL overload: Multiple small payments across platforms can quickly become a budgeting nightmare.

- Financial literacy gaps: Many families aren’t equipped with the tools or knowledge to navigate these systems safely.

What starts as a solution can quietly become a trap.

When Money Stress Becomes Family Stress

Financial strain doesn’t stay in the spreadsheet—it seeps into daily life.

- Parental burnout: Constant juggling of bills, guilt, and expectations leads to exhaustion.

- Relationship tension: Money worries are one of the top causes of conflict between partners.

- Kids feel it too: Children may not understand the numbers, but they feel the anxiety. Some internalize it, others act out.

Back-to-school season should be a time of connection—not quiet resentment and emotional withdrawal.

The Bigger Problem: It’s Not Just About Choices—It’s About Systems

Yes, some spending is optional. But much of it isn’t. And the deeper issue lies in how education is funded—and who’s expected to fill the gaps.

- Underfunded schools: Many rely on parent contributions to cover basic needs.

- Lack of universal support: Few governments offer comprehensive assistance for school-related expenses.

- Income inequality: Lower-income families bear the brunt, often forced to choose between essentials and dignity.

Until these structural issues are addressed, the burden will keep falling on those least equipped to carry it.

Back-to-School Shouldn’t Mean Back-to-Debt

This season is meant to be a fresh start—a celebration of learning, growth, and possibility. But for too many families, it’s a financial cliff disguised as a calendar date.